County Auditor

Barbara A. Parker, CPA, CIA

Contact Information

County Auditor

Barbara Parker, CPA, CIA

Email: b.parker@epcountytx.gov

Downtown County Annex

320 S Campbell Street, Suite 140

El Paso, Texas 79901

Phone (915) 273-3262

Fax (915) 273-3266

Monday-Friday

8:00 am - 5:00 pm

Divisions

Executive Management

System Support & Administration

Revenues

Accounts Payable

Internal Audit

Financial Reporting

Payroll

Treasury

Grants Compliance and Audit

EPCCSCD Fiscal Services

Debt obligations summary

Entity Name: County of El Paso, Texas

Type of Entity: County

Most recently completed fiscal year: 10/01/2021 - 09/30/2022

OVERVIEW

El Paso County issues debt to fund public infrastructures, such as new government buildings and renovations, water distribution systems, park improvements, and other projects that require significant capital investment. Using debt allows the County to complete a capital project with a repayment schedule that spreads the project's cost over the life of the Bond. The County reviews projects thoroughly regarding scope, feasibility, cost, the useful life of the financed asset, and capacity to repay debt. As a result, shorter-term capital outlays are funded with the maintenance and operations tax rate equal to two pennies rather than through debt issuance.

Major Initiatives: During fiscal year 2022, some of the completed major initiatives funded with the debt issued in previous fiscal years were the Tornillo-Guadalupe POE Bridge Sidewalk Improvements, Courthouse Walkways and Sidewalk, Upsala Project, Sportspark Improvements-Canopies and Medical Examiners HVAC Renovations.

![]()

DEBT OBLIGATIONS SUMMARY

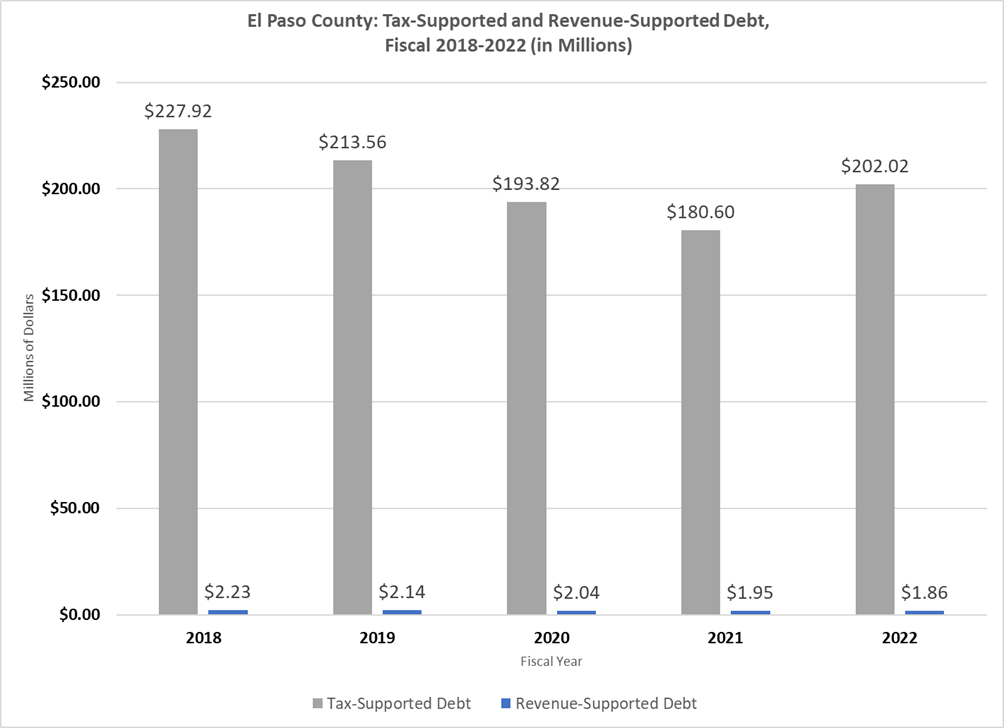

Total outstanding debt obligations: $203,872,191

Total tax-supported debt obligations: $202,017,076

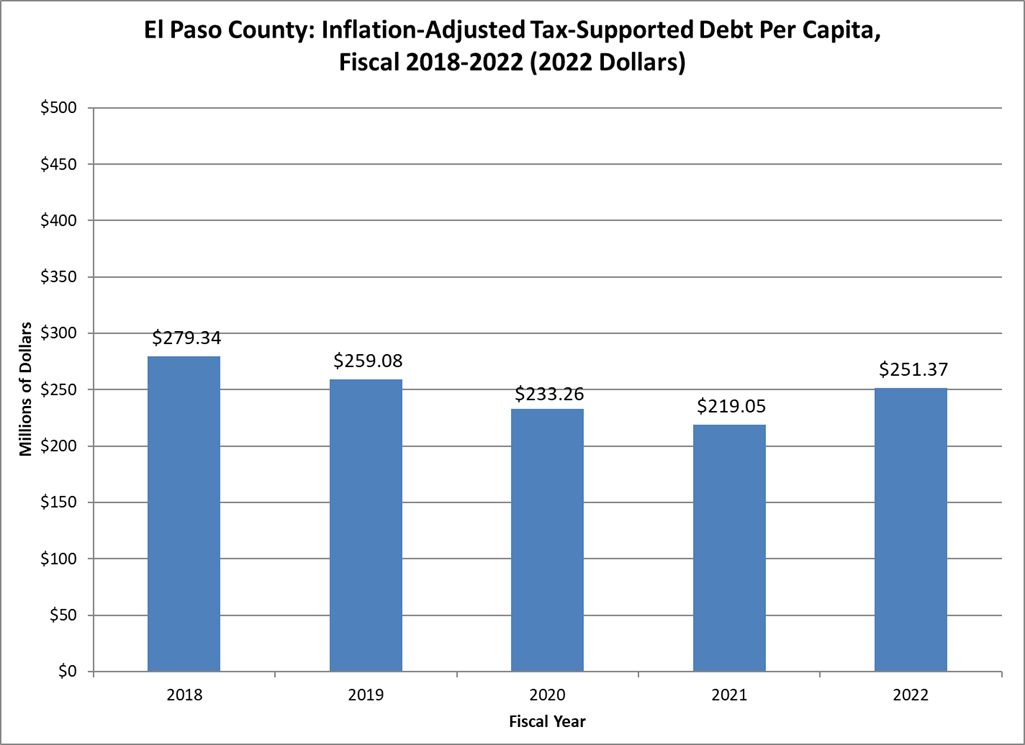

Total tax-supported debt obligations per capita: $233

Total revenue-supported debt obligations: $1,855,115

Total lease-purchase or lease-revenue obligations: $1,543,783

There were no bond elections during fiscal year 2022

Historical Bond Elections:

On November 3, 1992, El Paso County voters approved by 80,974 for and 35,935 against General Obligation Jail Bonds funding to pay the costs associated with constructing and equipment of the new County Jail Annex project totaling $35,000,000.

| Election Date | Proposition Number | Purpose | Amount | Status (enter approved or defeated) |

| 11/3/1992 | n/a | Constructing and equipment new County Jail Annex | $35,000,000.00 | Approved |

Tax-supported debt obligations are the combined principal and interest required to pay all outstanding debt obligations secured by ad valorem taxation on time and in full.

Revenue-supported tax obligations are the combined principal and interest required to pay all outstanding debt obligations that revenues will pay.

Total tax-supported debt obligations expressed as per capita is the ratio of tax-supported debt obligations to population (867,947 for fiscal year 2022).

NOTES

![]()

DOCUMENTS

Annual Debt Report Part 1

Annual Debt Report Part 2

2022 Tax Rates

Adopted Budget Debt Information

DOWNLOADABLE DATA

Time Trend for Outstanding Debt

Issue by Issue Listing

OTHER INFORMATION

Texas Comptroller of Public Accounts Debt at a Glance Tool

Bond Review Board Local Government Debt Data

Upcoming Bond Election Information - No Scheduled Bond Election